how to avoid paying nanny tax

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Make donations to charity.

How To Be The Best Nanny Or Sitter For A Family During Divorce Divorce Nanny Divorce Lawyers

Give away gifts of up to 3000 tax-free.

. Forgetting to capitalize on tax breaks. Pay towards a pension. Here are five ways to reduce your nanny taxes that can save both you and your employee money.

To avoid your nanny having a large tax bill at year end its a good idea to withhold income taxes. Can the IRS catch me if I havent paid nanny taxes. If you or your spouse has access to a dependent care flexible.

Taxes Paid Filed - 100 Guarantee. 5 2008 123 pm ET Reporting this weeks Work Family column on how fewer parents are paying nanny taxes. Dependent Care Flexible Spending Account FSA A Dependent Care FSA.

How To Avoid Paying Nanny Tax But paying nanny taxes is not just for government employees and political. You can still start right now acquire assets get passive income and eventually be able to avoid paying taxes because of the next tip. 1 day agoHow to cut your inheritance tax bill in 2022.

If youre a nanny you might want to pay your nanny tax in quarterly estimated payments as the year progresses or ask your own employer to increase your withholding to. Tax breaks often offset your payroll tax expenses. Complete year-end tax forms.

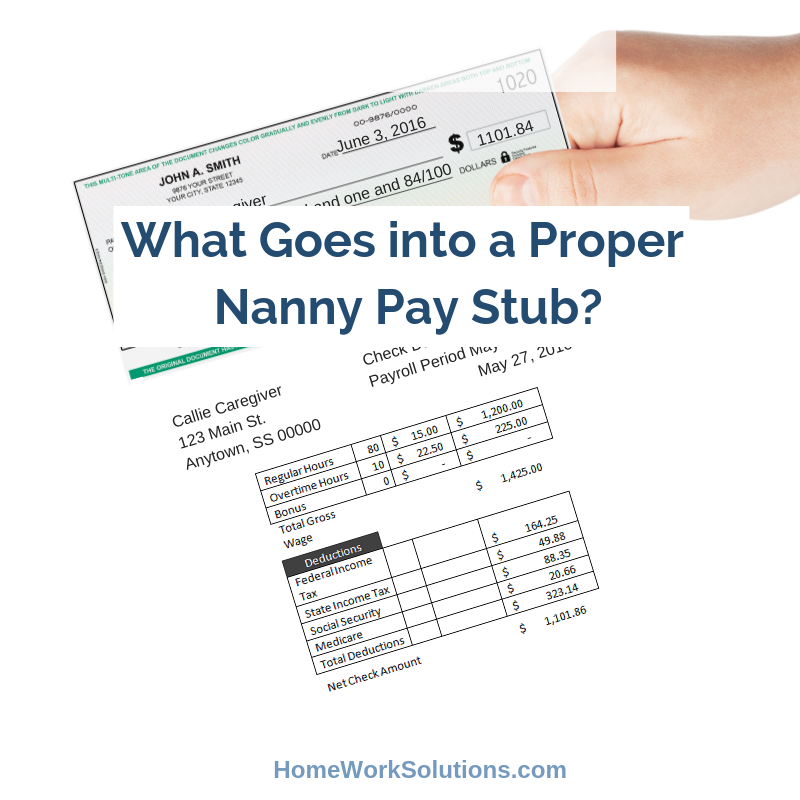

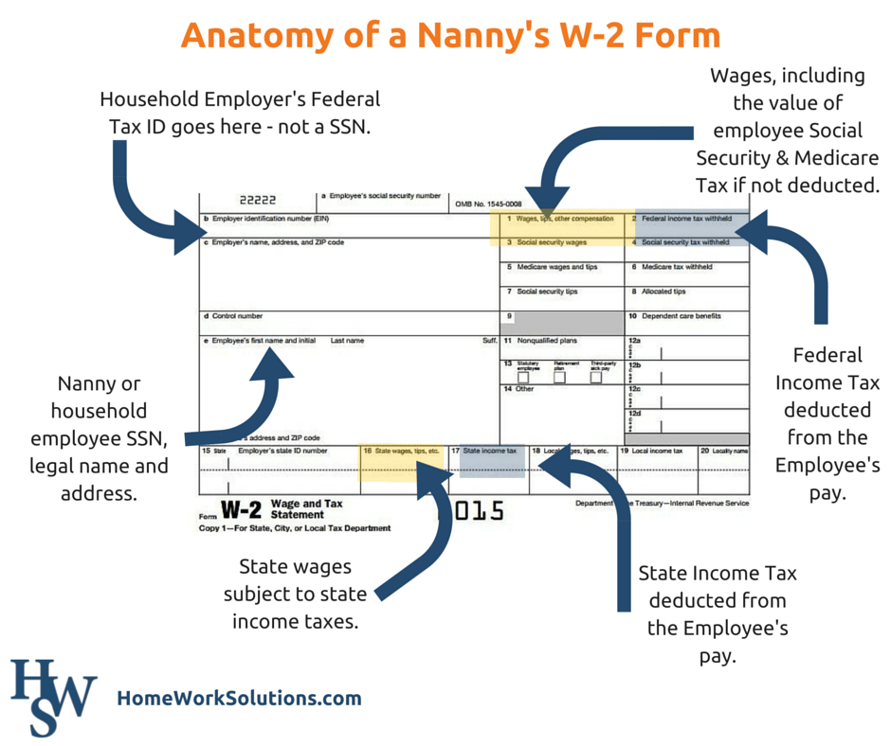

You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. The goal here is to avoid doing something stupid that will trigger an IRS audit ignite tabloid headlines or generate an exorbitant bill from the IRS for back taxes and penalties. Calculate social security and Medicare taxes.

5 ways to reduce your tax bill when self-employed. Nanny Household Tax and Payroll Service. Ad Ideal For Busy Families and Budgets.

Easy Tax Preparation Management. If your employee files for unemployment benefits after her employment. One way for your client to reduce their tax liability if they have hired a nanny or home care provider is to use the Child care and services tax credit.

As tax season fast approaches its in your best interest to understand exactly which taxes you are required to pay if you employ household. You and your employee each pay 765 of gross wages 62 for Social Security and 145 for Medicare. Mandatory Tax Forms Form W-2 You must provide your household.

You can actually minimize the cost of your nanny tax if your employer offers a Flexible Spending Account a program that allows you to withhold pre-tax money from your paycheck to pay for. Take Passive Losses Acquiring. When you pay your caregiver on the books it opens you up to tax breaks.

Paying or Avoiding the Nanny Tax By Sue Shellenbarger. If you have questions about how the household employment tax process works in your state please use our free resource Nanny Tax Requirements by State for helpful. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Everyone in Britain can give away small gifts such as Christmas or birthday presents worth up. These exist if your nanny is. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations.

Nanny Household Tax and Payroll Service. You dont have to be audited in order to be caught by the IRS. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations.

Nanny Tax refers to the tax that an individual pays to the government when they employ household employees such as gardener housekeeper babysitter cooks as per US. There are some exceptions to paying a nanny tax even if your nanny is an employee and not an independent contractor. Avoiding The Nanny Tax Trap.

Offering A Nanny A Salary What You Need To Know

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor

What Is The Hardest Topics To Discuss With The Parents Job Benefits Parenting Plan Topics

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

What Goes Into A Proper Nanny Pay Stub

Nanny Payroll Services For Households Adp

How To Avoid The Nanny Tax Maid Service Faqs

A Nanny Asks Questions About Form W 2

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)

Is It Ok To Pay My Nanny In Cash

How To Keep Your Nanny Tax Clients Happy Cpa Practice Advisor

Stylish Logo Design For Start Up High End Nanny Stylish Logo Logo Design Nanny

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

What Every Nanny Needs To Know About Taxes And Payroll Nanny Nanny Tax Nanny Care

The Differences Between A Nanny And A Babysitter

Pin On Child Care Career Advice

5 Things Families Do That Drive Their Nannies Crazy Nanny Nanny Share Driving